News

Stay up-to-date with the latest news from across Thailand and beyond with The Thaiger. Our dedicated team brings you breaking news, in-depth analysis, and exclusive stories from this stunning part of the world, covering a diverse range of topics, including local politics, business, culture, and tourism. Keep yourself informed about the Kingdom’s rich history, stunning landscapes, and thriving expat communities, as well as updates on events, attractions, and transportation.

The Thaiger is your essential resource for staying connected with Thailand’s captivating blend of tradition and modernity. To remain in the loop with the country’s most trusted news source, subscribe to our newsletter and follow us on social media.

-

Sponsored

Sponsored Fourtwenty High Garden 4/20 celebration 'Up in The Clouds'

Fourtwenty is thrilled to announce its flagship event “Up in The Clouds,” a celebratory gathering on the internationally recognized day of cannabis culture, April 20th (4/20), hosted at the scenic Fourtwenty High Garden. The event is set to kick off...

-

Asian shares plunge over 2% amid rising Middle East tensions

Asian shares experienced a significant plunge of over 2% as tensions rose in the Middle East, according to MSCI’s broadest index of Asia-Pacific shares. This was in response to reported Israeli missile attacks on Iranian sites, which also caused US stock futures to drop by 1.3%. The escalation in hostilities has driven the bond yields to tumble, with US long-term…

-

Thai-Chinese high-speed railway agreements near completion

The State Railway of Thailand (SRT) anticipates the closure of the final chapters in the Thai-Chinese high-speed railway’s first phase, reveals Deputy Transport Minister Surapong Piyachote. Spanning 251 kilometres and boasting a staggering budget of 179.4 billion baht, the ambitious project links the bustling heart of Bangkok to the vibrant cityscape of Nakhon Ratchasima. Divided into 14 meticulously crafted contracts,…

-

Japan’s visitor count hits record high with Thai tourists in the mix

Japan experienced a surge in foreign visitors in March, surpassing the three million mark for the first time in a single month. Thai tourists to Japan ranked sixth, contributing to the notable increase in visitors. South Korea topped the list with 663,100 visitors marking a 13.2% rise from 2019 pre-pandemic levels. Taiwan and China followed with 484,400 and 452,400 visitors…

-

Yala police officer critically wounded in midnight ambush

A police officer was critically injured in a late-night ambush while on patrol in Banang Sata, Yala province. The incident occurred around midnight close to a 7-Eleven store adjacent to Krung Thai Bank in Banang Sata sub-district. The officer, identified as Wacharaphong Chaiyaphan from the Banang Sata Police Station, was shot by an unidentified gunman and suffered a gunshot wound…

-

French national apprehended in Bangkok on kidnap charge

Bangkok’s Metropolitan Police Bureau apprehended a 45 year old French national at a hotel in the Silom area of Bang Rak district. The arrest, which took place around 10pm yesterday concerned allegations of a planned kidnapping of the young daughter of a renowned businesswoman, with a demand for a 200 million baht ransom. The arrest warrant for Sandra Christina Marie Diersten,…

-

BYD electric bus charges Thong Lo roads in Bangkok

In a move towards eco-friendly commuting, BYD, the leading electric vehicle (EV) manufacturer from China, has unleashed its electric bus onto the bustling streets of Bangkok. Offering complimentary rides to commuters in the vibrant Thong Lo area until April 30, this trial run marks a pivotal moment in Thailand’s transportation landscape. Under the auspices of Rever Commercial Vehicles Ltd, the…

-

Thai man allegedly fakes adultery story to extort money from couple

A Thai man allegedly faked an adultery story to extort 5,000 baht from a couple in the central province of Ayutthaya. He even pretended to be a death threat victim and sought help from a Thai news agency. A 42 year old Thai man named New told Channel 7 that he worked at a rice harvester garage in the central…

-

Fatal Ducati motorbike crash adds to Phuket road fatalities

A fatal accident involving a Ducati motorbike and a roadside barrier claimed the life of a 29 year old man yesterday in Kalim, north of Patong on the scenic Phuket coastal road. The unnamed victim, a resident of Moo 7, Mai Khao, suffered catastrophic head trauma in the collision, leading to his untimely demise. The crash was reported to Police…

-

Chiang Mai duo nabbed for 76 million baht home theft

Chiang Mai police apprehended two suspects in a brazen theft that saw 76 million baht stolen from a home. Police recovered nearly 40 million baht in cash, revealing that the culprits were known associates of the victim, motivated by a dispute over incomplete payment for work done. Other stolen assets were discarded in black bags. The incident, which occurred on…

-

Dead Burmese man found in water tank of Bangkok condo

The change in colour and odour of the tap water at a condominium in the Min Buri district of Bangkok led to the discovery of a dead Burmese man in a rooftop water tank early this morning. Residents alerted the condo’s owner about the slow flow of tap water, noting an unpleasant odour and a shift in its colour. The…

-

Phuket man escapes major harm as car collides with electricity pole

A Thai man narrowly avoided significant harm when his car collided with an electricity pole and subsequently caught fire in the early hours of this morning in Phuket Town. Phuket City Police received notification of the accident, which occurred close to the juncture of Phang Nga Road and Surin Road, at 1.55am today, April 19. On arrival at the scene,…

-

Brewing herbal revolution: Thai herbs poised to spice up global markets

Government spokesman Chai Wacharonke unveiled Prime Minister Srettha Thavisin’s master plan to transform Thai herbs into a formidable soft power product, captivating domestic and international markets. “Prime Minister Thavisin’s vision is crystal clear: to propel Thailand’s herbal industry to unprecedented heights, elevating the status of Thai herbs worldwide.” Harnessing the innate medicinal prowess, rich biodiversity, and indigenous knowledge embedded within…

-

10 year old girl shot dead over land concession conflict in Krabi

Police are searching for the gunman who shot dead a 10 year old girl on a palm plantation in the southern province of Krabi. The girl’s family believes the shooting was motivated by a dispute over land concessions. The fatal shooting took place in a palm plantation in the Khao Panom district of Krabi at about 8pm on Wednesday, April…

-

Phuket launches free electric bus to drive sustainable tourism

Phuket is gearing up for a greener future with the launch of a free air-conditioned electric bus service in the heart of the city. Scheduled to accelerate on May 9, this eco-friendly initiative is driven by a collaboration between local companies under the banner of PKCD and the Sustainable Tourism Development Foundation. The announcement for the 22-seat Smart Bus EV…

-

Transgender village head and boyfriend found dead in car

A transgender village head and her boyfriend allegedly yesterday committed suicide in a car parked outside a 7-Eleven convenience store in the central province of Ratchaburi. A 7-Eleven member of staff, Thatsaya Saetang, contacted Ban Pong Police Station officers at about 4pm yesterday, April 18 after she found the people unconscious in the car. Thatsaya explained that she noticed a…

-

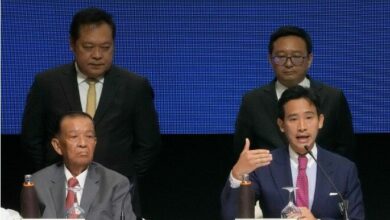

Thai PM’s power play: Srettha hints at defence portfolio addition

Prime Minister Srettha Thavisin drops hints of an unprecedented power move, hinting at the possibility of adding the defence portfolio to his already hefty workload. This bombshell revelation comes amidst swirling speculations about an imminent Cabinet reshuffle that could reshape Thailand’s political landscape. Addressing a curious press pool after the delayed Cabinet meeting, the 62 year old PM, wearing a…

-

Phuket Airport rescue department tackles local fires

Phuket International Airport’s Fire and Rescue Department was summoned to tackle two challenging fires in the nearby areas yesterday. The areas affected included an abandoned section opposite Thalang Technical College and Baan Mak Prok locality in Mai Khao. Both fires had rapidly spread across extensive plots of land, posing a considerable challenge to the firefighters. However, the airport rescue personnel,…

-

Thailand Video News | Phuket autonomy proposed amidst tourism crisis, British man arrested for using beggar earnings for drugs

In this video, Alex and Jay delve into the news across Thailand. Phuket’s Mayor proposes Special Administrative Status to rejuvenate tourism and infrastructure, while the nation seeks OECD membership to bolster economic growth. Tragedy strikes in Pathum Thani as a fatigue-induced crash claims a monk’s life. Meanwhile, in Koh Pha Ngan, a British man’s arrest for begging highlights ongoing challenges.…

-

Thai Ministry to reimburse victims of call centre scams

The Thai Ministry of Digital Economy and Society (DES) announced plans to reimburse victims with more than 10 billion baht worth of money and assets, previously seized from call centre scam operations. The assets, including 6 billion baht in cash, were retrieved by the Anti-Money Laundering Office (AMLO) in 2021, according to Minister Prasert Jantararuangtong. He iterated that AMLO is…

-

Pheu Thai Party eyes House Speaker position

The Pheu Thai Party is reportedly planning to reclaim the House Speaker position from the Prachachat Party, according to a source yesterday. This move is part of the ruling party’s strategy to restructure its parliamentary operations, and it is predicted that the position might be given to a prominent member of the party, possibly a minister who may be removed…

-

Don Mueang Airport flies high in world rankings

Don Mueang International Airport in Bangkok secured a top ten spot in the World’s Best Low-Cost Airline Terminals ranking, as announced by Skytrax. Suvarnabhumi International Airport also improved, climbing ten places to secure 58th position in the World’s Best Airport ranking. Skytrax, a renowned website for reviewing and ranking airports and airlines worldwide, conducted the rankings based on surveys and user…

-

Acting police chief suspends Big Joke over gambling links

The acting national police chief has signed a suspension order for Deputy Chief Surachate “Big Joke” Hakparn and four other subordinates over their alleged involvement with an online gambling network, as per a source close to the matter. The directive, which was enforced immediately yesterday, April 18, was signed by Pol. Gen. Kitrat Panphet. In addition to Big Joke, the…

-

MFP bill to penalise officials ignoring Parliament summons

The Move Forward Party (MFP) has tabled a bill in the Parliament penalising ministers and state officials who disregard summons to testify before House committees. The bill, proposed by Rangsiman Rome, an MFP list-MP and the head of a House committee on state security, was formally presented to Parliament yesterday, April 18. Under the proposed legislation, MPs who ignore their…

-

Thai and Taiwanese firms join to build medical products plant

Aiming to capitalise on the government’s initiative to make Thailand a medical hub in Southeast Asia, Thai firm Namwiwat Medical Corporation (Nam) and Taiwanese company Somnics Inc have joined forces to construct a new manufacturing plant. The facility, intended to serve as an export base, will produce a wide range of medical products, including sleep-enhancing devices. Nam, a local sterilised…

-

RTP seize 7.9 million baht assets from hybid-scam network

In a sweeping operation dubbed “The Purge,” Royal Thai Police (RTP) officers from Mueang Thong Thani, in collaboration with relevant agencies, made significant strides in the battle against transnational crime on April 17. RTP officers seized assets worth over 250 million baht (US$7.9 million) from hybid-scam networks, a substantial blow to these criminal operations. The hybid-scam network involved tricking unsuspecting…

-

Fire lights up Chiang Mai: Doi Suthep Forest blaze sparks alarm

The night skies over Chiang Mai were illuminated after a fire erupted in Doi Suthep Forest. The incident, reported by local media on Wednesday, April 17, was first sighted at a temple nestled within the forest. Phuping Forest fire officers from Doi Suthep-Pui National Park were the first ones to spot the blaze and were promptly dispatched to the site…

-

Jomtien Beach’s Songkran splash sees a dip in tourists

Jomtien Beach in Chon Buri experienced a noticeable dip in the usual influx of visitors during the recent Songkran celebration. The local businesses situated in the area attribute this decline to the newly introduced one-way traffic system, which they believe has puzzled and deterred potential tourists. Poolsawat Singhsawasdi, a vendor operating on the beachfront, expressed her concerns to the local…

-

Can a radical proposal save Phuket’s tourism crisis?

In a bid for autonomy, Phuket Mayor Saroj Angkanapilas is leading a daring move to transform the city into a special administrative organisation to save it from a tourism crisis. The current system, he claims, is holding back progress, leaving the island paradise struggling to keep pace with global rivals. “Tourist cities in many countries are far ahead in their…

Don't forget to check out some other things to do in Thailand - get help starting a business or finding a job in Thailand, buy Thailand property, rent a yacht or book a medical procedure worldwide.